Report: Retail Industry Trends 2023 (P2)

Retail Industry Trends 2023 part 2. The global retail system has faced many difficulties during COVID-19. However, besides difficulties and challenges, retail stores also proved their agility and flexibility in 2022. After part 1, the report will continue with these market predictions.

5. Catering services face inflation obstacles

Faced with rising food and labor prices after COVID-19, restaurants all simultaneously increased food service fees, and fast food brands are no exception.

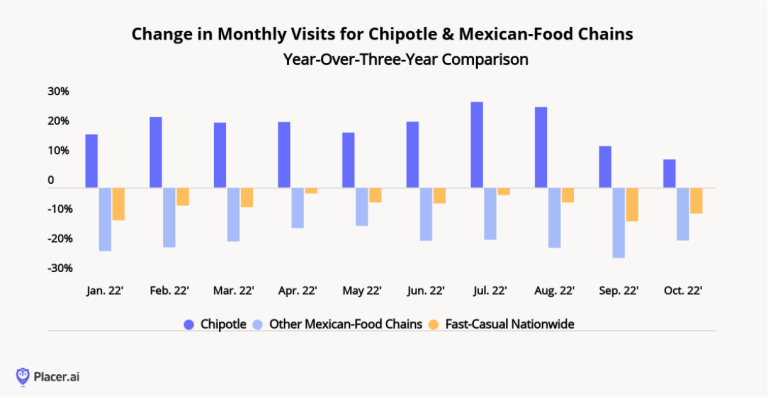

A prime example of the rise in service prices in the F&B Industry is the Chipotle restaurant. However, Chipotle is one of the few that has succeeded with this change and earned interest, while many other competitors still need to improve. So, why did Chipotle successfully raise prices without facing mixed opinions?

Chipotle Restaurant has implemented several strategies to offset prices and increase visits

Prominent strategies include:

- New creativity in the menu, encouraging the experience of customers.

- Invest in developing digital marketing, reaching customers through many communication channels.

- Innovation in retail branches located in crowded places focuses on small markets.

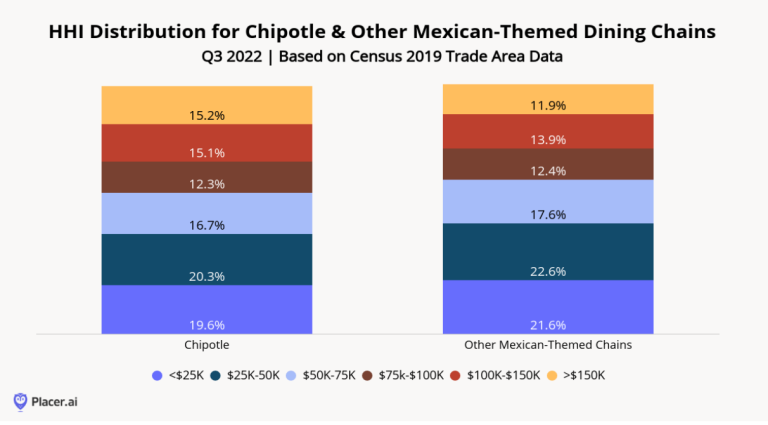

- Convert the main audience to high-income people.

The effectiveness of the strategies has been evident in the third quarter of 2022.

More than 30% of customers in Chipotle’s physical commercial area have household incomes higher than $100,000, compared with less than 26% in the commercial area of other Mexican restaurants. Chipotle has taken full advantage of this special advantage in difficult income times when the daily needs of high-income customers are rarely affected by price increases due to inflation.

Therefore, if you are always ready to innovate and meet the needs of the market and customers, then you have firmly grasped the key to the success of your business.

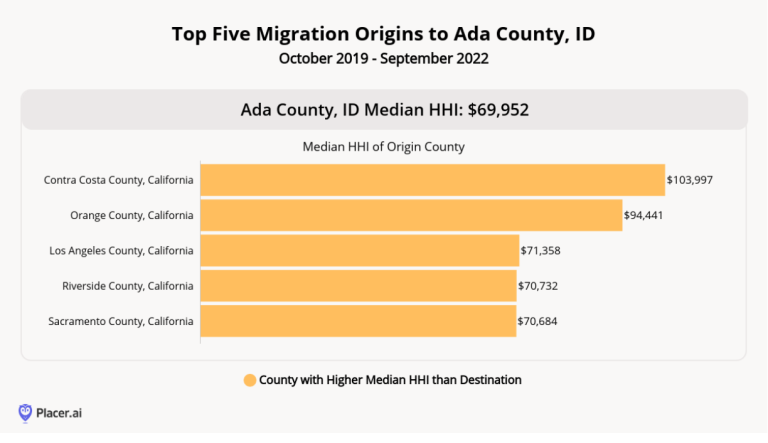

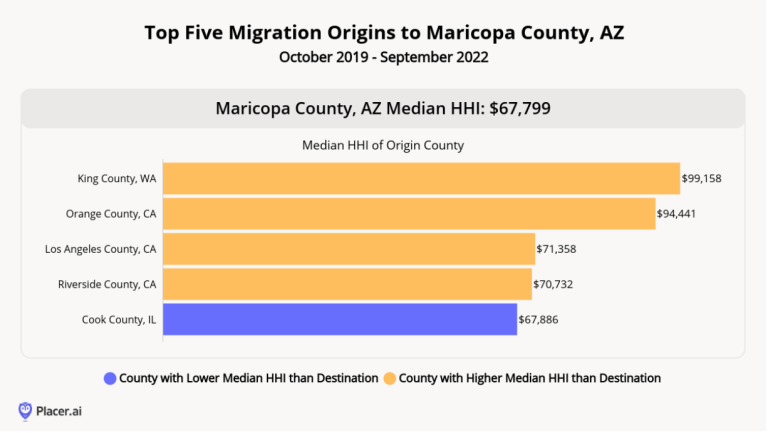

6. The gradual stabilization of migrants

Without a doubt, moving to an entirely new place is now considered a “trend”, with a significant number of people emigrating in recent years. Especially when the migration trend started showing signs of stabilization, this change has brought a lot of business opportunities for businesses.

Why can it be said that the stability of migrants has a direct effect on the income of enterprises?

In some cases, when new residents with high incomes integrate into the environment they have just moved into, their need to shop for the first time can increase, especially for essential products such as furniture and home improvement tools.

The large flow of new customers also can push many retailers to switch to research and business in markets where they previously had few opportunities. It can be mentioned as when a wholesale merchant realizes the great business potential of young tourists. Taking advantage of the homesick mentality when these people move from the city to the suburbs, they provide direct service in stores with a feeling of being at home and let this customer file have full access to the system.

Retail industry trends 2023

The migration trend is not only for people moving from the city to the suburbs. On the contrary, this trend also appears in urban areas, with a huge number of young populations arriving in big cities.

The migration trend has opened the door to only one opportunity for retailers targeting the Gen Z market – a group of customers with a buying mentality that is easily influenced by real experiences.

Remember, being aware of the potential for a change of residence, taking advantage of the situation, and capturing the interest of this group of customers, can help your business achieve more success than you think.

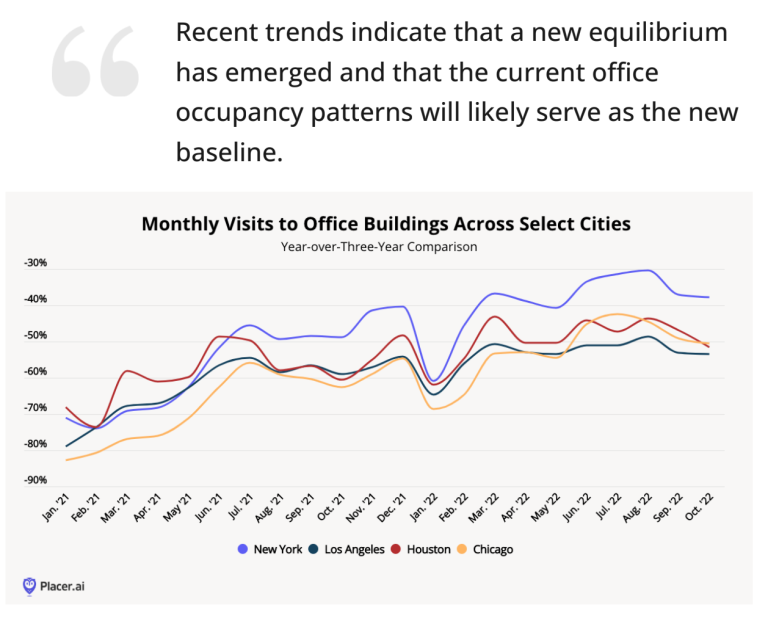

7. Can the “Work at the office” trend return?

The rise of “Hybrid working” (- combining working from home and the office) – has contributed to proactively scheduling time for office workers. They can be more proactive about their schedules and eliminate time-consuming commuting. However, this form of work also has specific effects on real estate as business owners begin to consider the need for an office location. This also affects local restaurants and retailers, as their main customer traffic often comes from office workers.

So, what can we expect if people return to “Work in the Office”?

While the return to work in the office took a good turn in early 2022, compared to 2019, this trend has unfortunately begun to slow down in recent months. After the pandemic, perhaps everything has been determined that the “Hybrid working” form will be a new form of working for office workers. However, at the same time, many difficulties and potential factors disturb this facility, such as the state of challenges that the top technology companies face, persistent inflation, high gasoline prices, or instability of migration patterns.

As most workers prefer “”Hybrid working”” to full-time online work, we expect Q1 to bring a major shift in the region’s “recovery” process. office space, but a full pre-COVID-19 recovery is unlikely. However, there is one thing that cannot be denied: the change in the working model will shift the business’s investment to focus on developing the comfort and attractiveness of the workplace, contributing to helping the business value and motivating employees.

Finally, working online is likely to be popular soon. Although the “Working at the office” trend is gradually stabilizing, the current situation is unlikely to stabilize until the conclusion. Final.

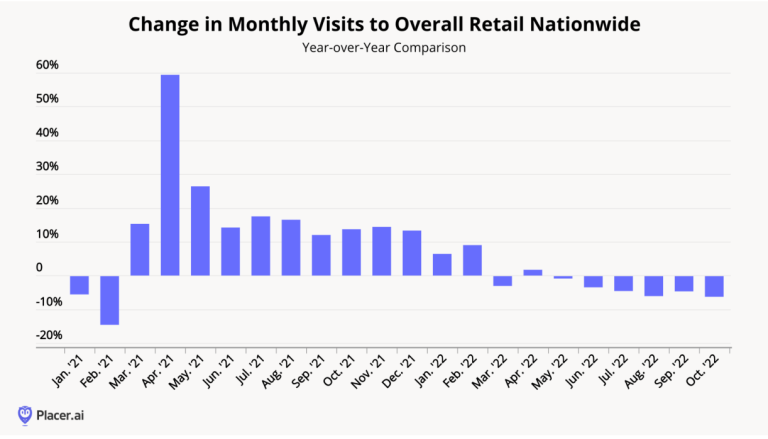

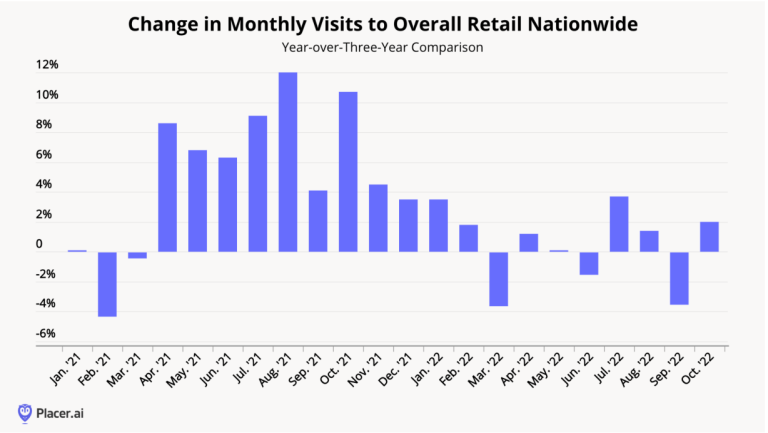

8. Retail boom at the beginning of the year

Summer shopping always faces challenges compared to 2021 – a particularly successful year. However, this is likely to be the opposite regarding shopping traffic at retail locations impacted by COVID last December.

The apparent influence of the unusual traffic pattern in the annual economic index report is likely to continue into early 2023, with a sharp increase in the index. The devastating impact of the COVID-19 strain Omicron on the travel industry last January and February set a very low threshold, which various retailers and business segments in 2023 must cross.

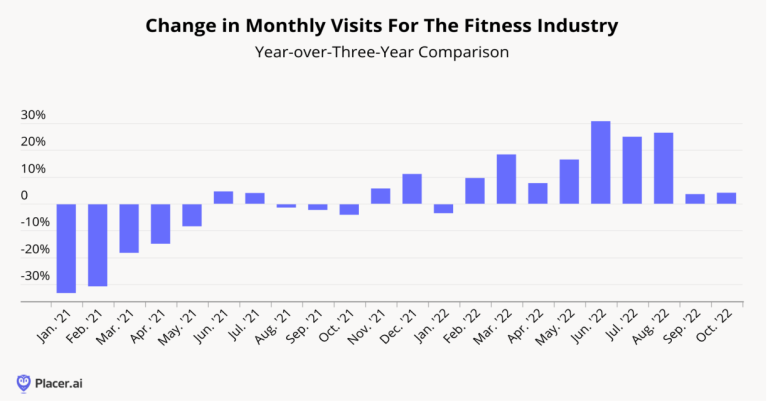

Even for the best-performing segments like Fitness, buying volume drops in January. However, this offers an opportunity for outstanding profits considering that the sector typically peaks in the first quarter. Retailers also get the chance to boost profits and give gifts for the holiday season, which will drive even higher traffic after Christmas.

9. Patience is the key

The pandemic began a period that lasted for a long time, filled with upheaval. However, every business person needs to remember that after suffering these unnecessary negative effects, the retail segments will be able to revive at any time.

A convincing example is still the Fitness industry. By mid-2020, many people thought that the growth of Peloton and other affiliated fitness brands signaled the demise of other gyms. While Fitness remains a unique niche, predicting a fundamental shift in how we exercise is premature. Fitness chains like Planet Fitness, Blink Fitness, and many others recovered and returned, achieving remarkable success in 2022. Moreover, they are more likely to maintain their success despite the setbacks. Economically, thanks to lower monthly costs than chains like Planet Fitness, consumer interest in health, and ultimately the new fitness services they offer.

The story of the Fitness industry’s return to the ring can also be applied to other service segments such as full-service restaurants or retail chains like Old Navy – also a victim of COVID-19, been severely affected in the past few years. The all-inclusive catering the category can only be appreciated more each time the economic and medical markets show a little more forgiveness. For retailers like Old Navy to stay successful in 2023, they need to take a broader view than they did three years ago, keeping in mind pre-pandemic trends and the lesson of thinking they’re too strong to be separated from the parent company.

Does this prediction suggest that any business that fails will fully recover with confidence? The answer is, of course, no. But confidence will still help your business gain a broader perspective when looking at business successes and failures after the pandemic before you are convinced that a must-have direction is positive or negative. , and continues even when the broader environment is normalized.

Summary of Retail Industry Trends in 2023

Retail communication network:

In-store communication is an interesting channel that can help increase sales for retailers, premises, and manufacturing units. However, the most valuable thing this change brings is helping us to expand our understanding of the potential of retail locations. Retail communication networks are not only the herald of an important discovery but also a step forward in the evolution of the retail industry.

Diversity of tenants:

The shift in store types in malls is gradually taking place, and with the traditional view of renting space fading away, many opportunities are opening up for retailers. Property owners can create richer experiences that enhance productivity by reinforcing off-peak times and more reasons for customers to shop more often.”

New Store Types:

The retail industry is seeing a boost in flexibility regarding overall store size, items sold, and store location. From Shop-in-Shops to tailoring the purchase journey to delivering innovations to customers and reaching diverse audiences in good locations – the change is happening, and the impact is significant. This helps retailers maximize individual store operations and identify the ideal way to avoid barriers to entry.

Small-scale commercial centers are gradually becoming popular again:

Leading shopping malls are thriving, making every retailer want a prime location for their store. This is happening at the same time that many of these shopping malls are shifting their focus from traditional to non-traditional tenants. As a result, competition is increasing. So where will the tenants go? While there are many options, one that is slowly emerging is mid-range shopping malls. This could be a massive hit beyond what we’ve seen before with major department stores. Still, it will only happen if retailers focus on differentiation and focus on customers’ target audience.

The resilience of the restaurant industry:

COVID-19 and inflation have caused a lot of trouble for the restaurant industry, but Chipotle’s ability to overcome obstacles has proven that using the right strategy can still lead to success. If you’re a restaurateur, follow Chipotle’s approach to updating menus, investing in digital marketing, and focusing on the small market. From there, easily adjust prices and survive in the competitive restaurant market.”

Migration stability:

The migration model is gradually stabilizing, helping businesses understand which changes are permanent and vice versa and avoid temporary changes. Therefore, 2023 is an opportunity for companies you understand to focus on solving new needs soon and seize the opportunity to nurture and develop relationships with this file of immigrant customers.

Office working form:

Office work has been more or less disrupted during COVID-19, and although there has been a certain recovery, it is still far from pre-pandemic. While we can see the longevity of “Work from home”, the result is still ambiguous. However, the effects of the transition to “Hybrid working” and “Work from home” will certainly become more apparent next year.

The boom in a year:

The devastating impact of the COVID-19 strain of Omicron has severely impacted physical retail locations in Q1 2022, and this low threshold is expected to create opportunities for various business segments. Surpassed in 2023. The boom in Q1 2023 is of particular importance for segments like Fitness, which typically peak at the start of the year.”

Business Patience:

The pandemic has begun a long, tumultuous period for the business. Some businesses fail, and others do better than usual. Therefore, patience is indispensable if we want a significant economic boost. If you run out of patience, that will be a big drawback for your business. However, more than patience is needed. The answer to your success or not lies in external factors, not only in core strength.