Report: Retail Industry Trends 2023 (P1)

Retail Industry Trends 2023. From COVID to inflation, although it has been facing many pressures in recent years, the traditional retail industry has successfully adapted to changes and proved to be resilient—sustainable Development. Bye-bye 2022 is over. Let’s look at the whole picture of the retail industry in the upcoming 2023.

Read Part 2 of the report here.

The brick-and-mortar retail industry has overcome most of its obstacles in recent years.

From the closures of 2020 to the ongoing COVID waves of 2021 and the soaring inflation and prices of 2022. Even so, consumer demand for retail services and direct retail remained high, with key categories continuously seeing growth again.

In fact, besides recovering, large retailers, food chains, or fitness brands can do more. Many companies find opportunities to establish new channels, develop more markets, and cater to new customer segments – and these developments pave the way to real success in 2020. 2023. In addition, there are still some significant challenges in this field, which will significantly affect retail activities ahead of the new year.

This article dives into some of the key trends that are likely to shape the retail industry trends landscape in 2023

From looking at the traffic of top brands and segments to analyzing displacement flows and data recovery patterns to making predictions about what could happen. So as we head into the new year, let’s find out what retail services and types in brick-and-mortar stores need to look out for.

1. Retail communication network

Retail communication networks will become the top trend in 2023.

The retail communication network, a key element of the digital world, is increasingly becoming an important part of the brick-and-mortar retail environment. This has opened an attractive opportunity for retailers, property owners, and manufacturers.

The retail media network is creating a compelling opportunity for retailers, property owners, and manufacturers.

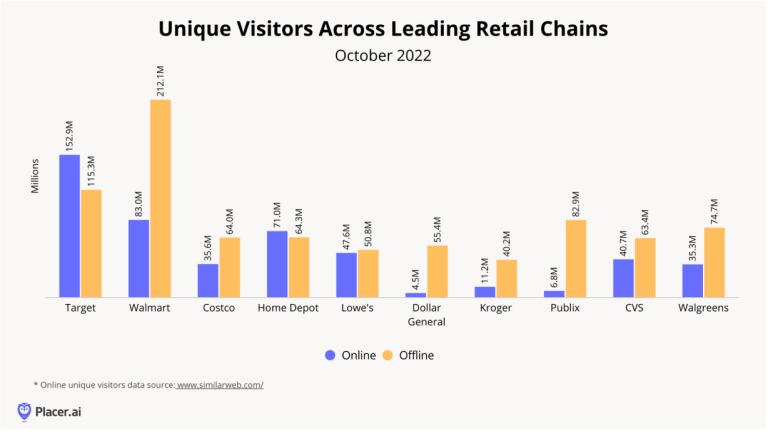

Companies like Amazon, Best Buy, Walmart, Target, or Albertsons are all investing in this space to increase sales and profits while taking advantage of the massive traffic levels between platforms. However, for advertisers, the main attraction lies in visitor intent and the point-of-purchase convenience that brick-and-mortar stores offer.

Looking at brick-and-mortar stores for their marketing and advertising value also allows retailers and product companies that advertise through them to think about user segmentation in fundamental ways.

An example of the 2023 retail industry trends that can be mentioned is the promotion of protein bars.

The promotional effect from cross-visits between a grocery store and a nearby gym will be far greater than doing a conventional demographic analysis. Furthermore, the retail media network allows advertisers to consider physical store visits and unique impressions like traditional advertising on television or online. This makes comparisons fairer, allowing advertisers to measure impact across advertising channels more effectively.

However, this is just the beginning.

Investing in everything from billboards to endcaps to stadium naming and concert advertising also drives field measurement and analysis to clarity and more detail. Although coming from a marketing channel that is still in its infancy, this leads to optimization and efficiency and creates tremendous opportunities.

Read more: What is Marketing 4P? Marketing Manual for Beginners

2. Diversified trends of short-term store rental

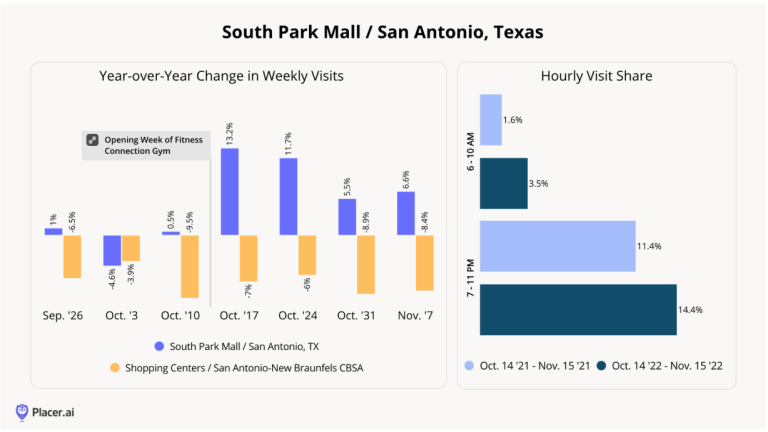

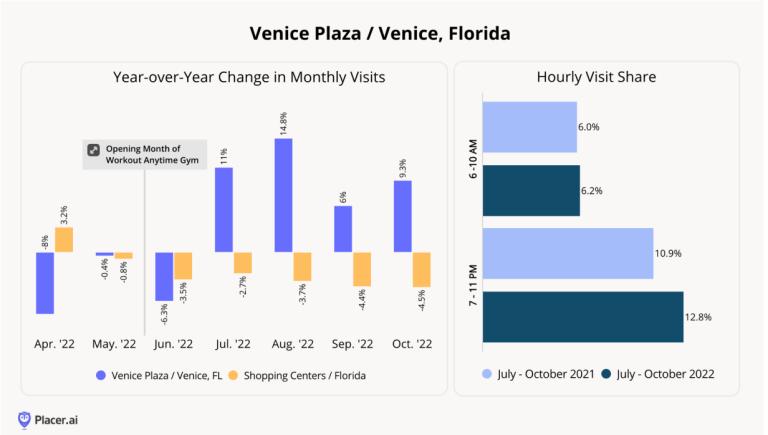

The COVID-19 pandemic is considered the apocalypse of the brick-and-mortar retail industry, as it has seen leading retail brands such as Sears and K-Mart close their doors on a large scale. However, while large businesses are starting to close, shopping centers are attracting new tenants according to the latest trend. From gyms to co-working spaces to clinics, the growing presence of non-retail tenants has had a lasting and significant impact on traditional retail space.

These units provide a range of benefits to retail businesses by increasing opportunities for retailers by generating a customer base during off-peak hours and reducing competition among retailers. These units also help enhance customers’ shopping experience when coming to the mall. This prolongs the time each customer stays in these malls and gives consumers more reasons to shop more often. These tenants also give landlords more choices, helping them identify the ideal tenant without being subject to traditional suitability restrictions.

Non-retail tenants prolong the length of time each customer stays in these malls and give consumers more reasons to shop more often.

Thus, the owner of the premises, the tenants, and the buyers all benefit. Landlords will especially love this trend as it increases their optionality when demand for space in top malls is rising.

3. Shop-in-Shops & New Store Types

In addition to the non-traditional tenant trends, the mass closures also provide a positive perspective that shows retailers’ push across segments to improve their retail footprint – and optimizing the Digitalization of brick-and-mortar stores is an essential part of this process. Equally important is the effort to maximize the potential of each location with a greater emphasis on the use of internal space and the size of the store as a whole.

Shop-in-Shops model (Stores are located in stores)

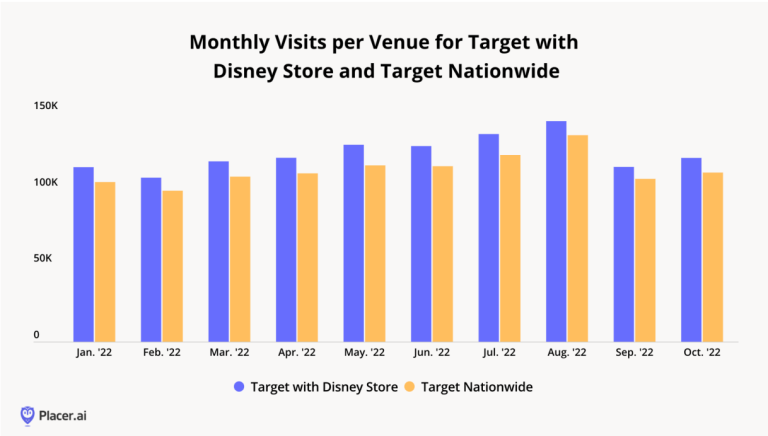

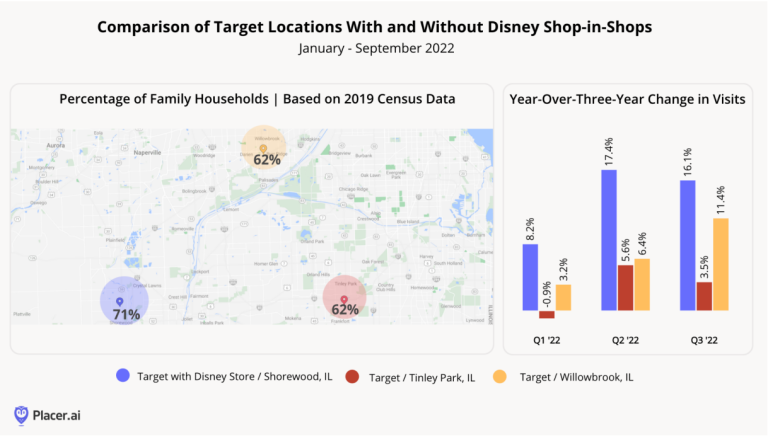

Starting with maximizing space inside the store, retail brands from Target to Kohl’s and Lowe’s have taken full advantage of it, finding ways to drive customer visits, increase cart size, and create engagement. Interact with new customers. This method of operation is relatively simple. The larger retailer fills gaps in its product portfolio, sets itself apart from competitors, improves engagement, and increases cart size. In addition, the smaller retailer has an efficient source of capital to expand its target audience and, in many cases, leverage the larger retailer’s online ordering and distribution channels.

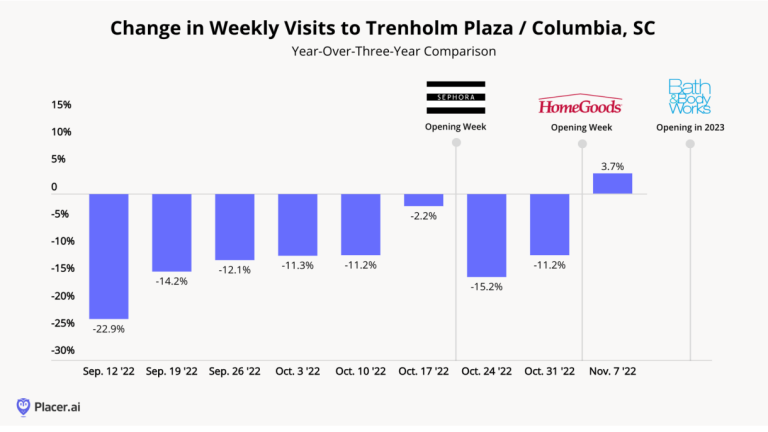

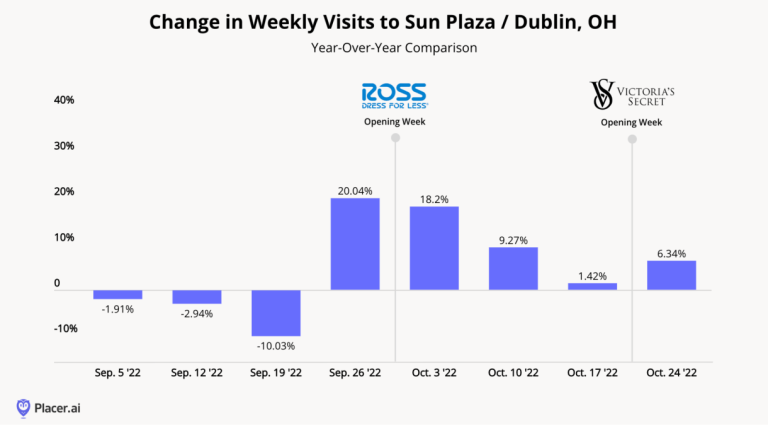

Extremely promising results

The shift is positive, with many retailers benefiting from shops-in-shop locations with higher annual and triennial visits growth compared to other places. This model also shows exceptional retention in aligning with the growing interest in finding ways to enter the brick-and-mortar retail market from local digital brands. On the other hand, Production-oriented companies or even retailers need help.

This concept highlights brick-and-mortar stores’ important but often overlooked element – they can serve as a platform for brands to maximize their reach. In a digital age heavily influenced by the ability to cross-sell online, leading brick-and-mortar retailers are now trying to bring that feature to the physical store.

Shaping Store Size

Another important aspect of experimenting with new store types revolved around the change in store size. Whether it’s small-scale stores or even larger store expansions, store type flexibility is key to optimizing a company’s retail operations. Small stores can enable retailers to maximize impact in a given market, identify the ideal locations to reach their target customers, and improve the store’s marketing value, focusing on reducing costs. Larger storefronts can create more experiential spaces and even enhance distribution for businesses.

However, retailers have many ways to optimize their physical presence beyond just choosing a niche for their store. And this flexibility allows companies to focus more on getting the right product to the right audience and maximizing the impact of each location. This process will lead to more tremendous success.

4. Small-scale commercial centers are gradually becoming popular again

The “overcrowding” of the number of malls in the US is now as common as the retail apocalypse story. Although somewhat true to the current situation, this is likely an exaggerated statement.

The increasing number of tenants coming to the leading commercial centers and the rapidly increasing demand for space from brands that want to “win” for prime locations has increased the competition for space. , prompting many potential tenants to look elsewhere. Alternatives include outdoor experience centers, downtown and strip malls, shop-in-shops, and pop-ups.

However, retailers should consider smaller shopping malls as their following location – and the opportunities here are tremendous.

Retailers who have struggled to stand out in a packed high-end mall can make them see that their value in a lower-tier mall is upended, giving them a stronger position in the market and more sales. And if these malls shift their focus from competing with major regional malls to focusing on specific audiences or offering differentiated experiences, the potential for accumulation could be enormous.

Crucially, the proliferation of smaller shopping malls requires them to seize the opportunity, focus on differentiation, and target customers to increase visits—necessary visits – significantly when the potential of high-end shopping centers is increasing, not decreasing. However, if this change takes place, it shows that the actual amount of “overcrowding” in the number of shopping centers is much less than previously predicted.